Stuart Varney

- Personalities

- Alexis Glick

- Neil Cavuto

- David Asman

- Cheryl Casone

- Dagen McDowell

- Liz Claman

- Adam Shapiro

- Ashley Webster

- Charles Payne

- Brian Sullivan

- Cody Willard

- Connell McShane

- Dave Ramsey

- Elizabeth MacDonald

- Eric Bolling

- Jeff Flock

- Jenna Lee

- Nicole Petallides

- Peter Barnes

- Rebecca Diamond

- Rich Edson

- Robert Gray

- Sandra Smith

- Shibani Joshi

- Stuart Varney

- Tom Sullivan

- Tracy Byrnes

- On Air

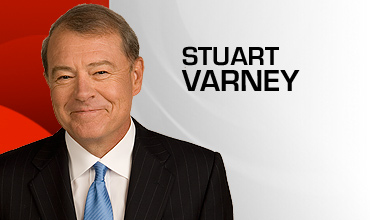

Stuart Varney

Veteran business journalist Stuart Varney joined FOX Business Network as an anchor in September 2007. He also serves as a business contributor and substitute host for FOX News Channel's Your World with Neil Cavuto.

Since joining FNC's business team in January 2004, Varney has contributed to the network's weekday and weekend business programming including Your World with Neil Cavuto, Bulls & Bears, Cavuto on Business and Cashin' In.

Prior to joining FNC, Varney served as the host of CNBC's Wall Street Journal Editorial Board with Stuart Varney. Before that, he was a co-anchor of CNN's Moneyline News Hour. Varney helped launch CNN's business news team in 1980 and hosted many of their financial programs including, Your Money, Business Day and Business Asia. His reporting and analysis of the stock market crash of 1987 helped earn CNN a Peabody Award for excellence in journalism.

A graduate of the London School of Economics, Varney began his broadcast journalism career as a business anchor for KEMO-TV in San Francisco.

FOX Translator

No data currently available.

No data currently available.

Think telemarketer. Except, it's much worse because you can't avoid this call. Instead, when you get one, it's time to pay up, because the bet you placed with borrowed money is eating itself.

Buying stocks on margin is risky because you're essentially "playing" with someone else's money. If the shares you purchased tank, your losses will likely be more than if you had bought the shares with your own cash. This is why the New York Stock Exchange and the Nasdaq impose certain restrictions on the practice.

Initially, you¿re only allowed to borrow half of the money from your broker when buying on margin. You set up a margin account and from then on must keep a maintenance balance of at least 25% of the market value of your stocks.

If the market value of your investment falls below this minimum, you're required to make up the difference by either depositing money into your account or selling some of the stock. If your broker notifies you that you've dipped below this minimum, it's called a margin call.

If you fail to adjust your account accordingly, the broker is authorized to sell shares in your account to make up the difference. The broker can even sell other stock in your margin account to make up for the loss that selling the shares didn't cover.

As an example, say you buy $8,000 in stocks of any given company. You borrow the maximum $4,000 from your broker and pay the rest yourself. Now, if and when the total value of these shares changes, you must make sure you maintain at least $2,000 (25%) in equity. In other words, if the total value were to drop below $6,000, you¿d be in trouble since you only put in $4,000 of your own money to begin with.