Entries from January 2009 ↓

January 21st, 2009 — Book Updates

So, what do you call it when the average price of houses in a city plunges by $88,522, or a riveting 17.5%?

If you’re Bonnie Wegerich, it’s a “stable and balanced market.” In fact, she adds, “there is no free fall here.”

And so is born the nation’s latest spokesmodel for real estate, another blinkered career realtor voted into a position of market influence and media stature, as president of one of our largest real estate boards. Like her counterparts in Toronto and Vancouver, Bonnie has interpreted her job as meaning she must try to restore consumer confidence in housing by fibbing about it.

At a forecast conference on Wednesday the 19-year housing veteran declared the average house price in Calgary this year will drop by 2% from its 2008 average, to just over $450,000. At the same time, she adds cheerily, sales will rise by 10%. “My advice,” she told a breathless metropolis of pent-up buyers, “don’t wait too long.”

But, there are a few problems. First, the average price now in Cowtown is $417,398, down from a peak of $505,920. So, for the average price to fall by 2% from the 2008 average, it will actually have to increase to $451,000, a jump of 8%. That’s about as likely as oil going back to $100 a barrel this year.

And speaking of oil, at forty bucks or so, it’s already low enough to have forced big cutbacks in new projects, to give Suncor its first loss in 17 years, to rob Alberta of $5 billion in royalties and cause the preem this week to say the collapse in oil sands expansion is “a No.1 issue for us in terms of jobs.” So where, exactly, is all this consumer confidence and money going to come from to jump housing prices in Calgary by four times the rate of inflation?

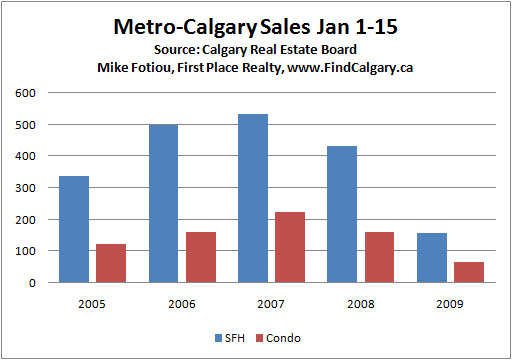

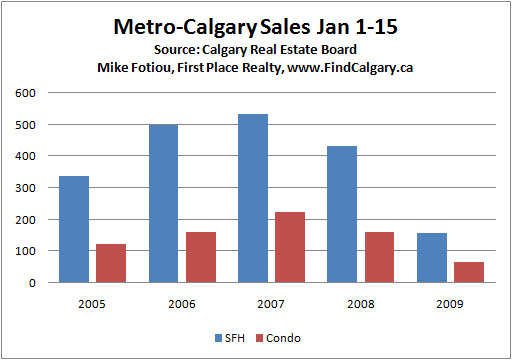

And what of market momentum? Fewer than 450 single family homes sold last month, a massive 47% decline from the same time a year earlier, and 33% lower than the previous month. Condo sales tanked by 48%. In fact, outgoing CREB spokesmodel Ed Jensen admitted how negative market sentiment is, saying “our third quarter really hurt us for unit sales.”

So, given a US-style collapse in sales, a US-style dump in prices, crushed commodity prices, buyers on strike and a screeching halt to oil industry expansion, what does Bonnie Wegerich give as her reasons the housing market is a great thing to jump into right now? Well, here is it, as detailed in her speech at Stampede Park: “I think some buyers are trying to predict the bottom of the market. But record low mortgage rates, affordable prices and great selection will eventually get people buying again.”

Then Bonnie closed her eyes tightly and clicked her heels three times.

Market update:

Here are the latest housing sales numbers, for the period ending a week ago. Is this what prompted Ms. Wegerich to declare the market ’stable’? I guess ‘deceased’ was too colourful a word.

Road trip update:

For those of you in the magic Kingdom of Vancouver who might want to attend my speech on Thursday, February 5th, here’s an update. I was informed yesterday the location has changed. But, happily, the admission price has not. It’s free, and worth every dime. If you want to attend, then call the guys who are brave enough to sponsor it, Dundee Wealth, at (604) 731-8900. Here’s the venue and time:

February 5, Vancouver BC

Financial Seminar

Plaza 500 Hotel, 500 W 12th St., (at Cambie)

6:30 pm

(604) 731-8900

January 20th, 2009 — Book Updates

TV screen shot of condomania on a planet called Richmond.

The Bank of Canada cut its key interest rate to the lowest point in history on Tuesday. Why?

“The outlook for the global economy has deteriorated since the bank’s December interest rate announcement, with the intensifying financial crisis spilling over into real economic activity,” the bank said in its gloomiest statement yet.

As a result, the dollar plunged to the 78-cent level. It’s now expected inflation will soon be less than zero – which, of course, isn’t inflation any more. It’s deflation.

Gosh, was it only six months ago economists were saying that was impossible?

On Tuesday, Suncor further slashed its capital budget – in half, actually. The company could lose $1 billion this year, with oil now in the $30 range.

Was it only six months ago Suncor was planning to spend $6 billion, while the Alberta oil giants were looking around for where to put a “tidal wave” of cash?

On Tuesday Bell said it would dump 1,500 workers, Bank of America sliced 4,000 and stock market traders drove markets hundreds of points lower as they watched the spectacle in Washington and worried about the global banking system.

On Monday came word real estate sales in Toronto have crashed by 50% this month. Last week Nortel went chips up. On the weekend the US bailed out its big banks once again. On Monday Britain did the same - after the mighty Royal Bank of Scotland announced a stunning $41-billion loss. Only a matter of time now before the UK nationalizes its banks. Then Washington.

If these were normal times, any one of these events would freak people out. They would portend a crisis in the making.

But, this is a crisis, so our media ignores it, as do many citizens.

Instead, it was wall-to-wall Obamarama. As if one man will part the waves of the flood engulfing us.

Meanwhile in Richmond, BC, buyers flocked to grab condos a developer was dumping on the market after creating a fake news event. In the middle of a housing price plunge, with the central bank desperately slashing rates, traders dumping banks, manufacturing and commodities in decline, and deflation stalking the land, why would they do so?

History will wonder.

January 20th, 2009 — Book Updates

With my toothbrush, laptop and memory stick all packed, I’m heading out over the next few weeks to do some yakking with Canadians. Part book tour, part speaking gigs, my goal is to help folks gain more of an understanding of the new economic and financial realities, how we got here, and what comes next.

All of the events listed here are free, and all but one are open to the public. If you’re nearby, drop in, as I’d be pleased and honoured to meet you. Some of these events are sponsored by financial advisors, some by real estate companies, some by a mutual fund. All of them understand my comments will be unvarnished and unedited. None of the companies or individuals who are staging these events have even seen my presentation.

And for that, they must be acknowledged. This is a time for plain speaking. Hope to see you.

January 20, London Ontario

Financial Seminar,

London Convention Centre

7 pm

For admission call (519) 858-2112

January 31, Victoria BC

Howe Street Money Show

Keynote address

Victoria Conference Centre

Pre-register to attend free

9 am

February 1, Nanaimo BC

Howe Street Money Show

Keynote address

Nanaimo Conference Centre

Pre-register to attend free

9 am

February 2, Parksville BC

Financial/Real Estate seminaSeminar

Tigh-na-mara Resort

6:30pm

For admission email, jimgrant@raymondjames.ca or lois@parksvillehomes.com

February 3, Vancouver BC

Corporate function, members only

12 noon

February 3, Surrey BC

Financial seminar

Northview Golf Club, 168th Street

7 pm

For admission call (604) 633-1418

February 4, Kelowna BC

Financial Seminar

Ramada Inn

7 pm

For admission call (250) 860-6494

February 5, Vancouver BC

Financial Seminar

Plaza 500 Hotel, 500 W 12th St,

6:30 pm

For admission call (604) 731-8900

February 12, Windsor Ontario

Details to be announced shortly

February 16, Halifax Nova Scotia

Details to be announced shortly

February 18, Listowel Ontario

Financial Seminar

Agricultural Hall,

7 pm

For admission call (519) 291-5316